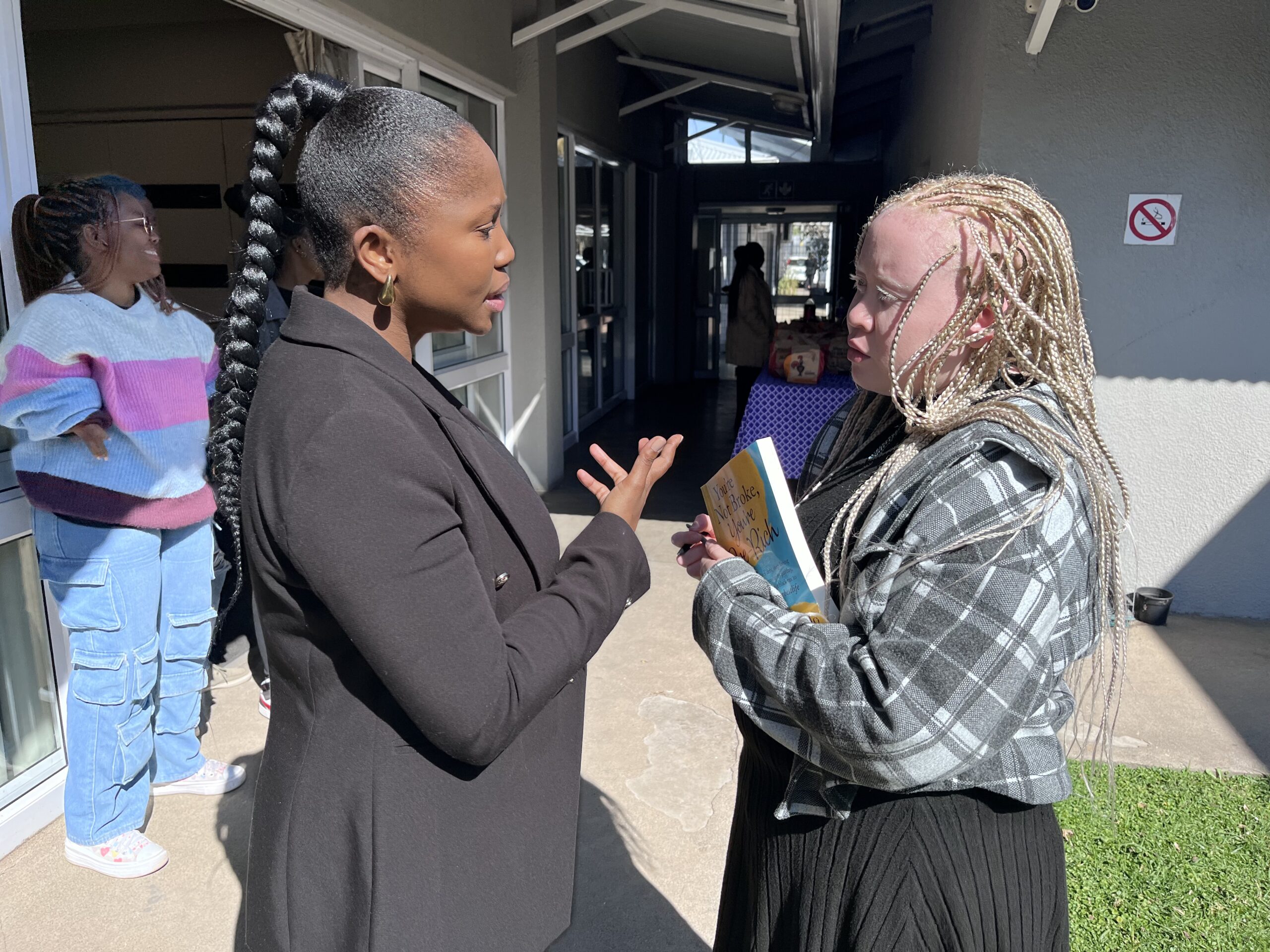

NCPD Staff members who benefitted from the financial literacy training

The Santam-sponsored financial literacy program transforms mindsets about money and builds financial confidence among staff members.

Edenvale, South Africa – After months of dedicated learning, laughter, and sometimes uncomfortable but necessary conversations about money, the National Council of and for Persons with Disabilities (NCPD) has successfully wrapped up a transformative financial literacy training programme that has genuinely changed lives.

The journey began in 2024 with a simple but profound question: “Do you remember the first time you accessed credit?” What followed was a year of monthly workshops at NCPD’s Edenvale headquarters, where staff members courageously confronted their money stories, challenged long-held beliefs, and equipped themselves with practical tools for financial freedom.

More Than Numbers: Addressing the Heart of Money Matters

Mapalo Makhu, the dynamic personal finance expert leading this transformation, recognised early on that financial literacy extends beyond spreadsheets and budgets. “Financial literacy is important for every single person,” she explained. “We explored topics such as budgeting and the emotional aspects of money, which are very important.” Money is not just about rands and cents. It also stems from how we grew up, how we view money.”

This emotional approach resonated powerfully with participants. Rather than diving straight into complex financial calculations, Makhu began each session by exploring the psychological foundations of money management. Participants discovered how childhood experiences, family attitudes, and cultural beliefs had shaped their financial behaviours—often in ways they’d never recognised.

The programme, generously sponsored by Santam, covered an impressive range of practical topics: debt management, the crucial difference between saving and investing, various marital contracts and their financial implications, estate planning, and the often-overlooked importance of having investments in one’s name.

Real Stories, Real Transformations

Lallie Kibido, whose enthusiasm was infectious throughout the program, couldn’t contain her excitement about the experience: “This was a very fruitful experience that I will never regret.” I invested my time in something truly remarkable, and the knowledge I gained will continue to enrich my life for many more wonderful years.

But it wasn’t just about acquiring knowledge – it was about practical application. Lallie continued, “It was great to learn about where to invest my money and time, and hearing about there being so many opportunities online, as a young woman, it inspires me to put my money into the right places.”

For Sicelo Mbatha, from the Casual Day team, the program provided a much-needed reality check. With refreshing honesty, he admitted, “I learnt that investing is very important, and it’s something that can also help you soon.” So saving is also significant, and knowing that I’m a shopaholic, I also learnt that I need to adjust to the lifestyle that I have created for myself and also think about the future—that saving is the most important thing.”

This kind of honest self-reflection became a hallmark of the sessions, creating a safe space where participants could acknowledge their financial challenges without judgment.

Learning from Lived Experience

One of the program’s most powerful elements was the inclusion of guest speakers, who brought real-world business experience to the discussions. Itumeleng Mosipu, founder and director of Zakhe Holdings and Trading, shared her journey as a person with a disability navigating the challenging world of entrepreneurship.

“Knowing how to start and where to go has been the biggest challenge on my journey,” Mosipu reflected with characteristic candour. “But then I learnt that it’s important to start with and also look for information—always look for information. ” There are always sources where you can find relevant information that you would need.”

Her presence reinforced a crucial message: financial literacy isn’t just about personal money management – it’s about empowerment, opportunity, and breaking cycles of dependency.

Building Lasting Partnerships with Purpose

Lebohang Boya, senior manager at NCPD, expressed genuine emotion when reflecting on the program’s impact: “This training was significant to our staff because the tools they’ve received they can carry out throughout their entire lives, and it will empower them in their financial journey.”

The partnership with Santam represents more than corporate sponsorship – it demonstrates how meaningful collaboration can create lasting change. “We would like to thank Santam for sponsoring the financial literacy training in partnership with Women in Finance,” Boya continued. “We are so grateful for the opportunity. We hope to further engage with Santam as well as Mapalo in growing our partnership.”

The Ripple Effect of Financial Education

What makes this program particularly significant is its potential to have a broader impact. NCPD staff members don’t just serve the disability community — they’re integral parts of families and communities themselves. The financial literacy skills they’ve gained will ripple outward, benefitting not only their families but also the persons with disabilities they serve professionally.

Mapalo Makhu’s approach, which combines practical financial education with emotional intelligence, has created a foundation for lifelong learning. Her book “You Are Not Broke, You Are Pre-Rich” and her Woman and Finance platform continue to support participants beyond the formal programme completion.

As NCPD looks toward the future, this successful collaboration with Santam sets a powerful precedent for how corporate investment in financial education can create meaningful, lasting change within vulnerable communities. The objective measure of success won’t just be improved credit scores or larger savings accounts—it will be the confidence, empowerment, and financial security that participants carry forward into their futures.

For more information about the NCPD’s programs, visit www.ncpd.org.za. To learn more about financial literacy resources, visit www.womanandfinance.co.za.